Unfortunately, little has been written about the opposite phenomenon. Namely a company deliberately understating its true economic performance over an extended period of time.

As Adam Smith wrote in its book Supermoney, “(…) corporate managers in the thirties and forties did not fear inflation, they feared going broke. They wanted a cushion against adversity, and sometimes that impulse led them piling up cash far beyond their needs.”

For any J-investor this sounds familiar. In 2014 Japan’s corporate cash hoard amounted to a staggering 1,9 trillion Dollars.

Adam Smith goes on to note that: “(…) (Management) actually hid their earnings through a variety of devices and reserves so that they would have something for the leanyears. (…)”

This post will tackle the issue of underreporting earnings. Basically it is the concept of “Quality of Earnings” turned upside down. I will label the concept of debunking the hidden earning power of a company “The Nice in Disguise Concept (NID- Concept)”. Basically, it is forensic security analysis and scrutinizes and adjusts for the real cost structure and extraordinary items of any given company. In this post the concept of “The Nice in Disguise” will be applied to Osaka Gas.

Company Overview

Osaka Gas is the second largest gas utility in Japan. It is supplying approximately seven million clients in the Kansai region (Osaka, Kyoto and Kobe). The company also moved into the power generation business right after the liberalization of the electric utility market. But the majority of its sales still stems from the gas business. Apart from the aforementioned electric power segment it is also engaged in other businesses such as energy, appliances, gas engineering, real estate and chemical business.

Valuation and Analysis of Operating Metrics

Osaka Gas stated valuation metrics are reasonable, but not mouth watering. Stated P/E stands at 14 and stated P/B at roughly 1. Another rather cheap stock in Japan, but apparently nothing to write home about.

So where’s the beef?

Well, the stateted numbers are underreporting the true earning power for Osaka Gas. In FY2014 alone that let to an adjusted price- earning ratio of 10. Roughly 30% below if stated numbers were used for calculation the ratio.

But it gets even nastier. Through several accounting devices the company has been deflating its income all the way down to the bottom line in the P&L account for more than 17 years now.

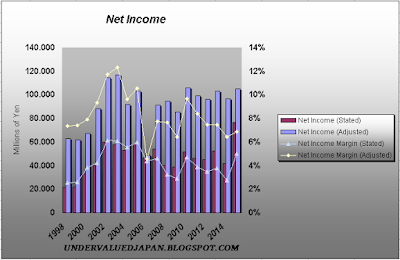

In the last 17 years stated net income matched adjusted net income only one time (in 2006). But in the last FY (2014) the two metrics converged significantly. While the average divergence of stated vs. adjusted net income margin is 4,2% vs. 8,2% it has finally narrowed in the most recent financial statement (5% vs. 6,88%).

For operating income and margins the divergence is even more stable and more pronounced.

Stated operating income never approximated adjusted numbers in any meaningful manner. For FY2014 the difference in stated operating margins vs. the adjusted one is 6,88% vs. 9,41%. The average reading are 7,7% vs. 11,3%.

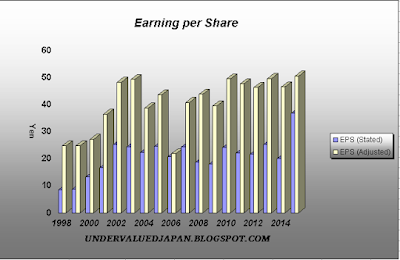

Logically, if operating and net income are understated so is earning per shar (EPS). The 17 year average stated EPS at Osaka Gas is underreported by almost half (21 Yen vs. 41 Yen).

Implication for Balance Sheet

The distortions of highly conservative accounting practice, which Osaka Gas has been using over an extended period of time, does not stop at the income instatement. It adversely impacts the balance sheet too. Basically, Osaka Gas has been allowed to built up hidden reserves since right of the beginning of this data series. But the phenomenon of understating the PP&E account and retained earnings gained traction in 2000 and went into full swing in 2006.

Concerning stated vs. adjusted book value per share (BPS), even when taking the stated figures for granted, Osaka Gas was not a bad BPS compounder. Its stated tangible BPS has been growing by roughly 7% p.a. during the last 15 Years. But if the astute security analyst applies the NID- Concept to Osaka Gas the real growth rate of BPS turns out to be rather 10% (conservatively calculated!). It outstrips the stated BPS growth rate by 300 basis points p.a. Those are not small numbers, especially if the investor intends to hold its investment for the long run!

Not all of the hidden assets are really hidden in Osaka Gas’s case. Osaka Gas mentions in a footnote discrepancy between stated numbers in the PP&E accounts and the fair value. But those numbers are only a fraction of the overall PP&E account distortion. Not to mention the understatement of retained earnings!

Having mentioned all the positive effects on the income statement and balance sheet when the NID- Concept is applied, one has to take note that the understatement of the balance sheet can also imply a negative feed back loop. Mainly concerning operational metrics, namely return on equity (ROE) and return on assets (ROA). Two diverging effects (a trade-off) are at work here. Intuitively one would expect the real ROE being higher than the stated one due to the upward adjustment of net-income. But the positive effect can be overcompensated by the negative effect of higher adjusted net assets. Thus, it could lead to an overall negative impact on real ROE.

Implication for Operating Cash- Flow

The impact of conservative accounting on operating cash flow is straight forward and the primary reason why a company is following such a policy. Basically, for a profitable company the operating cash- flow is augmented by beneficial effects on the company’s tax burden. Conservative accounting act as an tax shield by reducing the amount of taxes paid in any given year.

Implication for Pay- out Ratios

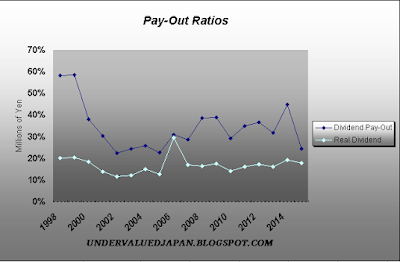

Osaka Gas states in his latest annual reports that it intends to pay-out roughly 30% in dividends to its shareholders.

In the past Osaka Gas made up for the huge discrepancy between intended pay-out and real pay-out by repurchasing back significant amounts of shares (mostly at bargain prices). But since FY 2011 Osaka has not been purchasing a single share. Real dividend pay-out has settled down at an annoyingly low 17%. Not nice Osaka Gas!

Implication for Intrinsic Value

If the interested investor would take Osaka Gas’s stated numbers for granted it should be conclusive to the reader that he would also understate its intrinsic value by a huge margin.

Following charts show several intrinsic value indications for the adjusted and non adjusted numbers of Osaka Gas..

Conclusion

The choice of accounting policy by management is highly discretionary and impacts all financial accounts of a company. Being aware of this discretion and scrutinizing the presented numbers diligently is paramount for the successful investor. In the case of Osaka Gas the numbers stated by the management have been depressing the earning power value for an extended period of time.

Concerning the overall outcome for the individual shareholder in a company that is understating its earning power one has to note that the overall result is conflicting. Tax saving by the company has to be regarded as a plus. Also has the company bargaining power when it comes to negotiations with its labour unions. But those positive effects are often thwarted by a low real pay-out ratio of those companies.

Concerning the effect on return metrics when the NID-Concept is applied it is important to have in mind that ROE and ROA can be impacted positively or negatively. The outcome depends on the percentage wise increase of net income in relation to book value.

Like Adam Smith I am convinced that the time will come for the old tenet in investing. Namely, anticipating the institutions. “(…) While Institutions are big and muscular, their records are not all that awesome. (…) their managers (…) tend to run in packs like beagles. All you have to do is to find the scent before the beagles do.”

The concept of Nice in Disguise will certainly help you being ahead of the pack.

Disclosure: long Osaka Gas

Where did you get these adjusted numbers?

ReplyDeleteMay friend excel gave them to me.

DeleteI was actually wondering where you got the original adjusted numbers from. Were they presented as "adjusted earnings" in the company's financials/press releases, or did you calculate them by adding something to the company's net income? If the second, what did you add?

DeleteFor sure I adjusted the numbers. Is the post so ambiguous?

DeleteHow do you do your analysis. Taking the numbers presented to you by management for granted?

How did you adjust the numbers?

DeleteSpecifically, what did you add to the company's net income to get the adjusted numbers?

DeleteThe usual stuff. Mainly extraordinary items that are not cash-flow relevant. Adjusted for certain accounting practices by management which I deemed too conservative.

DeleteAre you familiar with the concept of quality of earnings?

I am; I was just curious what specific accounting practices you were reversing, since I wanted to understand what exactly you were doing to see if I felt the same way on those practices.

DeleteYes, the post was very ambiguous regarding what adjustments were made. It was a muddle of a thesis really. Charles Hang's question was very fair - the arrogant response was uncalled for.

ReplyDeleteSo you are of the opinion that Chatles Hang asked the right questions in a polite and intelligent manner? I do not!

ReplyDeleteI certainly apologize if you thought my questions were impolite; that was definitely not my intention.

DeleteI actually greatly enjoyed this post and was perhaps overly enthusiastic in asking my clarifying questions.

As for asking unintelligent questions, I didn't want to make assumptions, so I may have asked overly simplistic questions. I again apologize if you thought they were asked in an excessively unintelligent manner.

No problem Charles.

ReplyDeleteUnintellegent was not the right adjective. Oversimplistic is more appropriate.

If I appeared arrogant I have to apologize too to you. It was not my intention.

It is just that I put quite some effort in my posts. So it would be nice to start a question/ comment with something like "an interesting read, but ...." or "thanks for sharing, but...."

That's understandable; thanks for clarifying! Thanks also for all of the work you put into your posts!

Delete